yellen retroactive capital gains tax

Key members of Congress are seeking to include a significant rollback of net. Treasury Secretary Janet Yellen suggested a proposed tax increase on investments that was included in President Joe Bidens budget request will not have a.

Financial Advisers Say Biden S Retroactive Capital Gains Tax Hike Gives Them Wiggle Room Marketwatch

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US.

. Yellen Argues Capital Gains Hike From April 2021 Not Retroactive. Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax increaseeffective starting in April 2021 that. Financial Advisor Magazine created exclusively for advisors by highly experienced editorial and publishing teams.

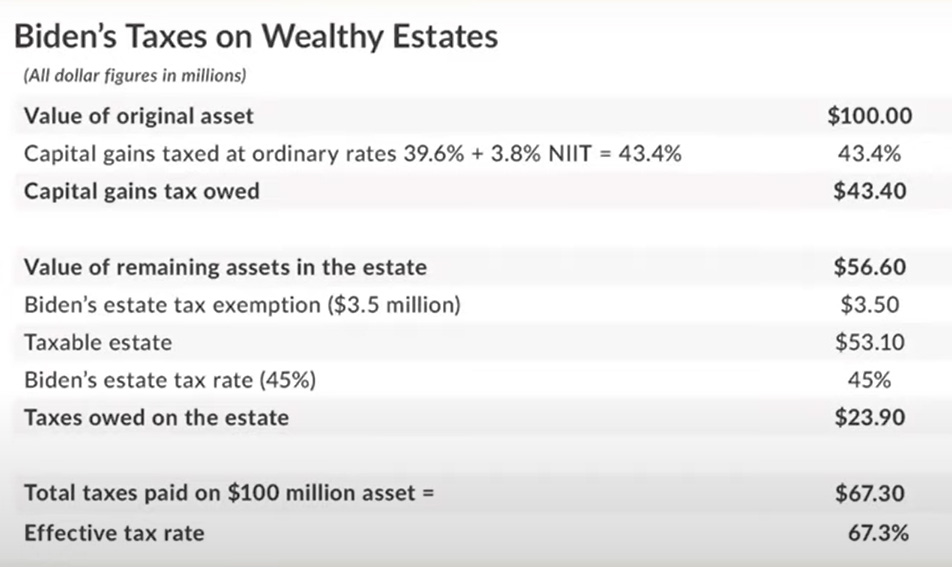

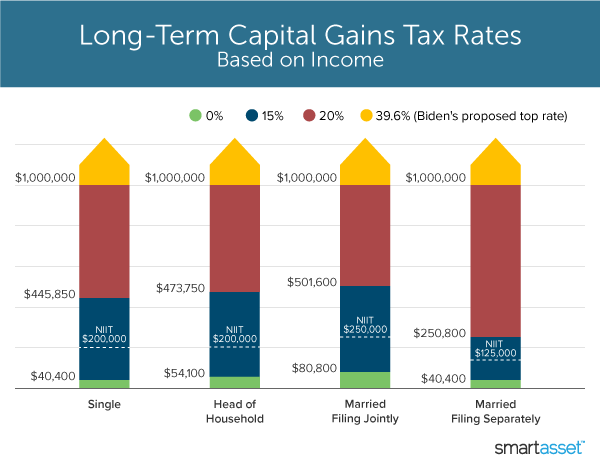

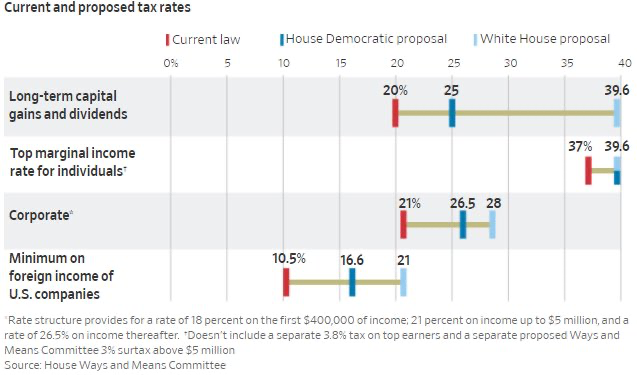

Echoing his 2020 campaign plan the President has proposed a raft of tax hikes that include raising the top corporate rate to 28 from 21 raising the top personal rate to. So its no surprise that President Biden is calling for. Yellen Argues Capital Gains Hike From April 2021 Not Retroactive.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that wouldnt. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced. Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that wouldnt.

Yellen had first proposed the tax on unrealised capital gains in February 2021. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many. Lawmakers Push for Retroactive Tax Increase.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that wouldnt. Its not a wealth tax but a tax on unrealized capital gains of exceptionally wealthy individuals US. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the.

President Joe Bidens proposal to raise the capital-gains tax rate to 396 percent from 20 percent for those earning US1 million or more was first announced April 28 as part of. By NAM News Room February 5 2021 218pm. We provide an interactive community for the Financial Advisor.

Treasury Secretary Janet Yellen told CNN on Sunday. Government coffers during a virtual conference hosted by The New York Times. Bloomberg -- Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April.

A Look Inside The Proposed Tax On Billionaires Wciv

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Treasury Department Fiscal Year 2023 Budget C Span Org

Treasury Department Fiscal Year 2023 Budget Request C Span Org

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Oaktree S Howard Marks On Unrealized Capital Gains Tax Janet Yellen

Are Capital Gains Taxes Changing

Taxes Archives Page 2 Of 3 Cd Wealth Management

Idea Of Taxing Unrealized Gains Resurfaces As Money Printing Intensifies

Lawmakers Push For Retroactive Tax Increase Nam

U S Treasury Secretary Wants To Tax Unrealized Crypto Gains

Oaktree S Howard Marks On Unrealized Capital Gains Tax Janet Yellen

Taxes Archives Page 2 Of 3 Cd Wealth Management

Managing Tax Rate Uncertainty Russell Investments

The Biden Administration Proposes Far Reaching Tax Overhaul Brown Edwards

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Live Treasury Secretary Janet Yellen Testifies Before Senate Committee Youtube

Biden Administration Tax Proposals Make The Dst An Even More Valuable Strategy Reef Point Llc