montgomery county al sales tax return

The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a. TAX DAY IS APRIL 17th.

Alabama Sales Tax Guide For Businesses

The Montgomery County Sales Tax is 25.

. The Alabama state sales tax rate is currently 4. Motor FuelGasolineOther Fuel Tax Form. The minimum combined 2022 sales tax rate for Montgomery County Alabama is 763.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Montgomery County Commission Tax Audit. Instructions for Uploading a File.

This is the total of state county and city sales tax rates. Police Jurisdiction Sales Tax. Check here for any changes in business _____ City of Montgomery co Compass Bank and.

The current total local sales tax rate in Montgomery County AL is 6500. The Montgomery County AL is not responsible for the content of external sites. County SalesUse Tax co Sarah G.

Object Moved This document may be found here. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return.

The latest sales tax rate for Montgomery AL. You will be redirected to the destination page below in 0. 334-625-2994 Hours 730 am.

2020 rates included for use while preparing your income tax. Montgomery County Alabama Sales Tax Sellers Use Tax Consumers Use Tax Education Only Tax MAIL RETURN WITH REMITTANCE TO. Thank you for visiting the Montgomery County AL.

Start filing your tax return now. Montgomery County collects a 25 local. All returns with zero tax payment or SEBP 702 Any correspondence should be mailed to.

The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250. Sales Tax Sellers UseConsumers Use Tax Tax Period _____ MAIL RETURN WITH REMITTANCE TO. This is the total of state and county sales tax rates.

However However pursuant to Section 40-23-7. Taxpayer Bill of Rights. Act 2012-279 required the Alabama Department of Revenue to develop and make available to taxpayers an electronic single-point of filing for state county andor municipal sales use and.

SalesSellers UseConsumers Use Tax Form. What is the sales tax rate in Montgomery Alabama. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

Check here for any changes in business _____ City of Montgomery co Compass Bank and. The December 2020 total local sales tax rate was also 6500. A county-wide sales tax rate of 25 is applicable to localities in Montgomery County in addition to the 4 Alabama sales tax.

This rate includes any state county city and local sales taxes. Montgomery AL 36104 Phone. Rental Tax Return- City.

If you need access to a database of all Alabama local sales tax rates visit the sales tax data page. Spear Montgomery County Revenue Commissioner PO. Sales Tax Sellers UseConsumers Use Tax Tax Period _____ MAIL RETURN WITH REMITTANCE TO.

Form St Ex A2 Fillable Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project

Montgomery County Al Businesses For Sale Bizbuysell

New One Spot Electronic Filing System Simplifies Alabama Business Taxes

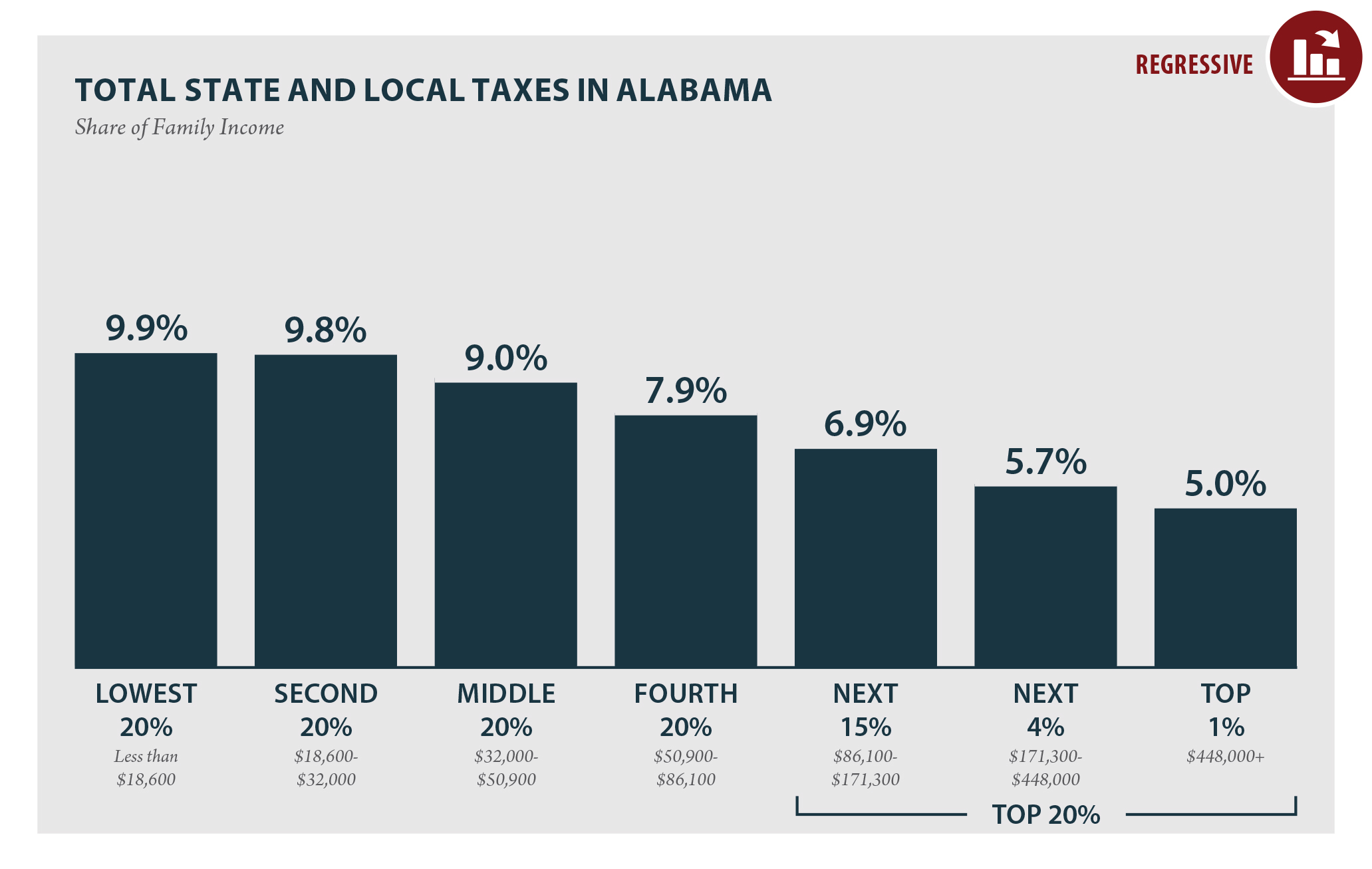

The Less You Make The More You Pay Alabama S Taxes Remain Upside Down Alabama Arise

Montgomery County Alabama Public Records Directory

Fill Free Fillable Forms Montgomery County Virginia

Fillable Online Revenue Alabama Application For Sales And Use Tax Certificate Of Exemption Revenue Alabama Fax Email Print Pdffiller

Alabama Property Tax Calculator Smartasset

Montgomery County Alabama Public Records Directory

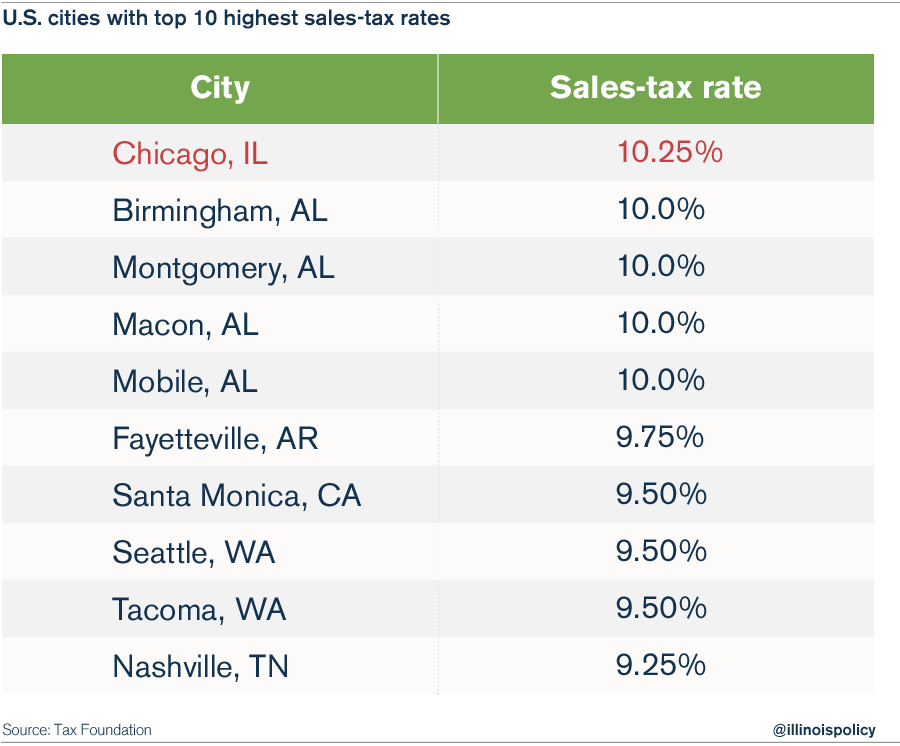

Chicago Now Home To The Nation S Highest Sales Tax

Ohio Sales Tax Small Business Guide Truic

Sales Tax Alabama Department Of Revenue

Sales Tax Alabama Department Of Revenue

Special Sales Tax Board Tuscaloosa County Alabama

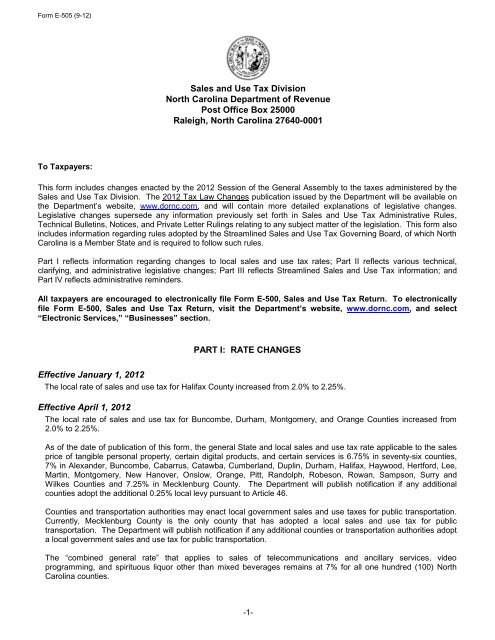

2012 Form E 505 Nc Department Of Revenue

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation